PLANNED GIVING

After reading about creating a will, you will be able to create your own will at no cost.

A biblical will is a last will and testament that was prayerfully designed with scriptures and biblical concepts in mind.

WHY IS IT IMPORTANT TO HAVE A BIBLICAL WILL?

-

- God wants us to be good stewards: 1 Corinthians 4:2

- God wants us to provide for our loved ones: 1 Timothy 5-8

- God wants us to give cheerfully to the Lord’s work: 2 Corinthians 9:6-7

- God doesn’t want our heirs to get too much too soon: Proverbs 20:21

Whether writing your will from scratch, or updating your existing will, our Will and Trust Planning Ministry will fully prepare you – from a scriptural perspective –to have your will or trust drafted with an attorney.

HELPING YOU IMPACT THE WORLD FOR CHRIST; THROUGH YOUR WILL:

-

- How do you plan for your spouse, children, parents, or grandchildren?

- What does the Bible say about taxes and debt?

- How do you plan for a child who wastes money or is living an ungodly lifestyle?

- Will the amount of inheritance you leave your children draw them closer to Jesus or push them further away?

- How do you choose the right guardians to raise your minor children if you and your spouse both pass away?

- What’s the best way to transfer remaining retirement?

What Assets Can I Give

What assets am I able to give outside of writing a check?

Appreciated Assets includes items such as publicly traded stock, closely held stock, bonds, mutual fund shares and real estate.

WHY GIVE APPRECIATED ASSETS?

When Christians give to their church and other ministries they care about, most simply give from their income or cash reserves. However, this is not always the best plan of stewardship for the giver. Giving appreciated assets such as stocks, bonds, mutual funds and real estate provide double tax benefits not available when giving cash. You not only receive a charitable deduction for the fair market value of your gift, but you also avoid capital gains tax. As stewards in God’s kingdom, we should take advantage of tax incentives available to us in order to harness as much as possible for the Lord’s work and our families. So, if you’re thinking of selling an appreciated asset and you want to give back to the Lord, we can help. We can assist you in developing the best plan of stewardship as you give to your church and other ministries you care about. This service is a gift to you for your faithful support.

THE POSSIBILITIES ARE NUMEROUS

-

-

Publicly traded stock

-

Mutual funds

-

Bonds

-

Real Estate

-

Business Interests

-

Private C-Corp stock

-

S-Corp stock

-

FLP or LLC shares

-

Mineral rights

-

Gold and Silver

-

Cryptocurrency

-

APPRECIATED GIFT EXAMPLES

If you’re not able to give the entire appreciated asset, there are many other possibilities available to you. Below are a couple of examples.

PART GIFT – PART SALE

Let’s say, for instance, you have 500 acres of appreciated farmland you want to sell. Prior to entering into a sale agreement, you could gift 250 acres to ministry. Then you and the ministry would sell the property together. You would receive a tax deduction for the fair market value of your gift and avoid 50% of your capital gains tax upon sale. These tax savings could then be used to help offset, or possibly eliminate, the capital gains tax on the portion of the property you kept for yourself.

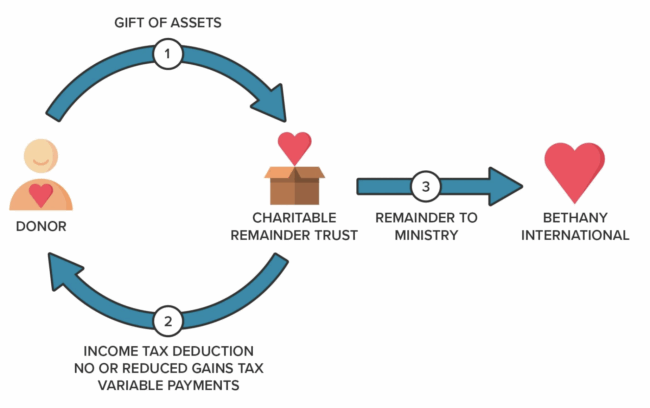

GIFT AND INCOME STREAM

Using the scenario above, you could also gift all or part of the farmland into a charitable trust and sell the land in the tax-free environment of the trust. The trust would be designed to pay you income for life or a term of years. When the trust terminates, the funds remaining in it become a gift to your favorite ministries. Through this gifting option, you also avoid the capital gains tax and receive a charitable deduction for your generous gift.

Charitable Giving Tools

What charitable tools are available to me in different situations?

WHAT TOOLS CAN I USE TO GIVE?

When Christians give to their church and other ministries they care about, they often give cash. However, giving cash is not always the best plan of stewardship for the giver. For example, did you know that you can receive a double tax benefit when giving appreciated assets such as stock or real estate?

As stewards in God’s kingdom, we should take advantage of tax incentives available in order to harness as many resources as possible for the Lord’s work and our families. To accomplish this, we provide a comprehensive, biblically based stewardship ministry to assist you in making a variety of non-cash gifts. This ministry is a gift to you as our faithful partner.

Giving Appreciated Stock

Giving From Your IRA

Giving Appreciated Real Estate

Donor Advised Funds (DAFs)

Giving When Selling a Business

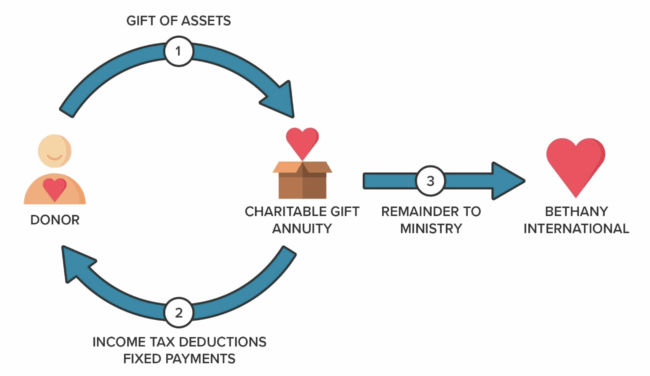

Charitable Gift Annuities (CGAs)

Charitable Remainder Trusts (CRT)

Giving When You Pass On

Giving Life Insurance

Will & Trust Planning Ministry

Cryptocurrency

Cryptocurrency gifts require special care in order to qualify for a charitable deduction.

If you have questions related to making gifts from stock and/or crypto currency, please contact Randy Dirks at Randy.Dirks@bethanyintl.org or 952-334-0049.

GET STARTED

For questions, call Randy Dirks at 952-334-0049 or complete the form at the bottom of the page.

Randy Dirks, PhD

Senior Stewardship Advisor

randy.dirks@bethanyintl.org

952.334.0049